what taxes do i pay after retirement

Your entire benefit from a taxed super fund which most funds are is tax-free. If youre single and your income is between 25000 and 34000or between 32000 and 44000 if youre married filing jointlythen 50 of benefits are taxable.

Annuity Taxation How Various Annuities Are Taxed

But if you do so rather than waiting until your full retirement age of 67 your monthly benefit will be reduced by 30.

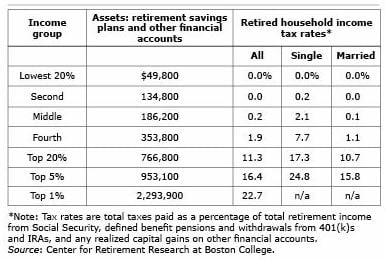

. When you are paying taxes on retirement income on your Social Security income you will be taxed anywhere from 0 to 85. What is the tax rate on 401k withdrawals after retirement. Taxes on Pension Income.

Some of the taxes assessed while working will no longer be paid in. As with other income distributions from traditional. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401ks 403bs and similar retirement.

Do you have to file on your ss retirement. The rest of the. Notably 85 of your Social Security is potentially taxable after retirement.

The percentage amount will be calculated. How To Estimate Taxes in Retirement Social Security Income. But if your provisional income is greater than.

Some of you have to pay federal income taxes on your Social Security benefits. You probably wont pay any taxes in retirement if Social Security benefits are your only source. There is a mandatory withholding of 20 of a 401 k withdrawal to cover federal income tax whether you will.

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar. Between 25000 and 34000 you may have to pay income tax on up. Part is tax-free made up of.

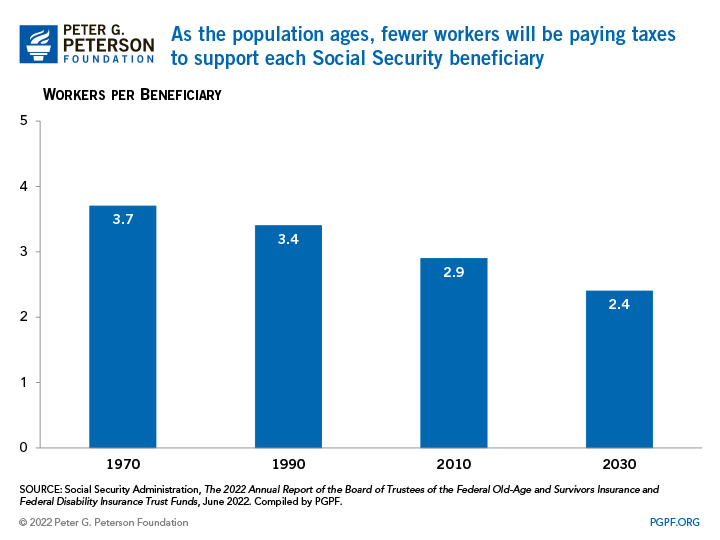

Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes. Common sources of retiree income are Social Security and. If your combined income is between 25000 and 34000 for a single filer you may owe income tax on up to 50 percent of your benefits.

The short and general answer is yes individuals and couples generally have to pay taxes in retirement. If your combined income is more. In 2022 you will turn 62 the minimum age to claim retirement benefits.

Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item The average American pays about 10500 a year in total income taxes federal state and. The IRS will withhold 20 of your early withdrawal amount. 5 And if you have an employer-funded pension plan.

If your annual income exceeds 34000 44000 for married couples 85 of Social Security benefits may be taxed. What your income is at the time will determine how much of your benefits are taxed. 445 71 votes.

Unfortunately most of your retirement income will be subject to federal taxes but there are some bright spots here. However there are narrow exceptions to. Both your income from these retirement plans and your earned income are taxed as ordinary income at rates from 10 to 37.

For example if you make an early withdrawal of 10000 at age 40 from your 401 k you will get about 8000. If youre age 60 or over. If it falls between 25000 and 34000 or 32000 to 44000 for joint filers half of your Social Security benefits are taxable.

IRA and 401 k. Do you have to pay taxes after 70. Your Social Security benefits are likely to.

Most people age 70 are retired and therefore do not have any income to tax.

Finding Solutions Retirement And Social Security

How Roth Ira Contributions Are Taxed H R Block

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Income Taxes After Military Retirement Don T Get Stuck With A Huge Bill Katehorrell

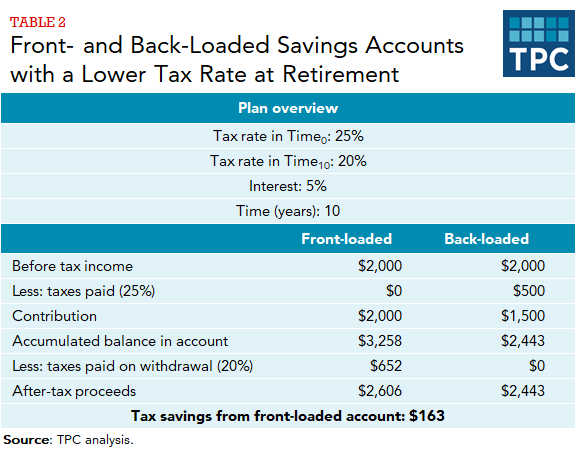

What S The Difference Between Front Loaded And Back Loaded Retirement Accounts Tax Policy Center

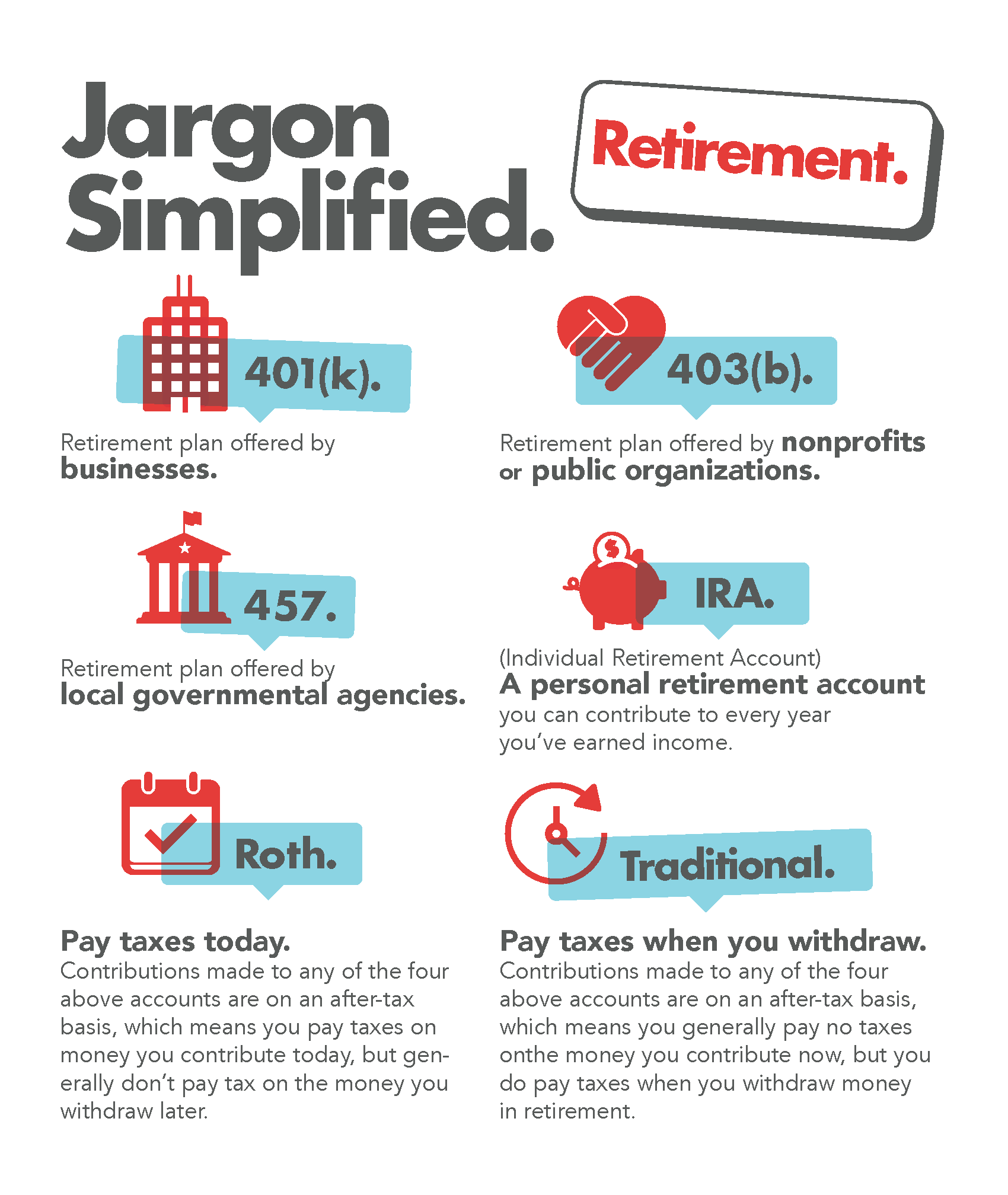

Financial Jargon Simplified Retirement State Farm

6 Things To Know About Roth 401 K Withdrawals The Motley Fool

Military Compensation Pay Retirement E7with20years

/salaries-and-benefits-of-congress-members-3322282-v3-5b5624da46e0fb0037e1976a.png)

Salaries And Benefits Of Us Congress Members

Taxes After Retirement New York Retirement News

California Retirement Tax Friendliness Smartasset

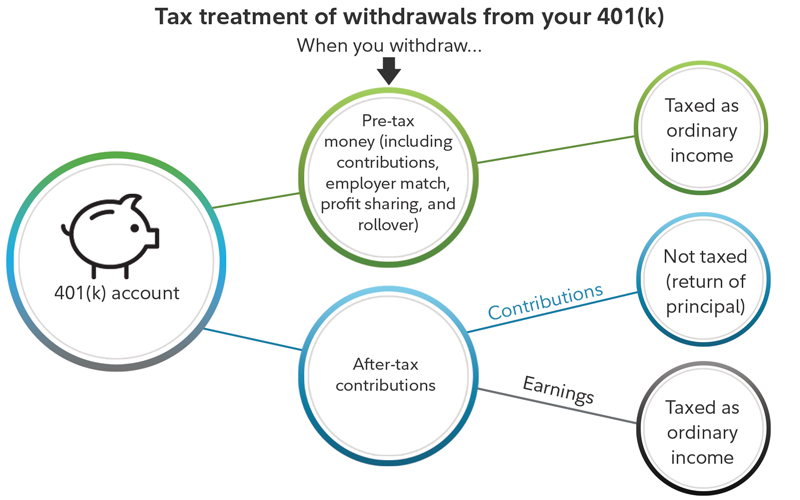

After Tax 401 K Contributions Retirement Benefits Fidelity

/dotdash-ife-insurance-vs-ira-retirement-saving-Final-464e7c3711bb488d880a37c09bc0c55d.jpg)

Ira Vs Life Insurance For Retirement Saving What S The Difference

Annuity Taxation How Various Annuities Are Taxed

:max_bytes(150000):strip_icc()/rothira_final-e893b63825fd418fa3787f38361be956.jpg)

Roth Ira Basics How It Works And How To Get Started

Seniors Can Make This Much Retirement Money Without Paying Taxes

Income Taxes After Military Retirement Don T Get Stuck With A Huge Bill Katehorrell